Want to delve deeper into Can I Cash App Myself Money From A Credit Card? Read this article to gain broader knowledge.

Can I Cash App Myself Money from a Credit Card?

In a financial bind, you might consider transferring money to yourself from your credit card to cover expenses or pay off debts. While this can be a tempting solution, it’s important to understand the potential risks and consequences of such a transaction. Let’s delve into the details of cashing app yourself money from a credit card and explore alternative options.

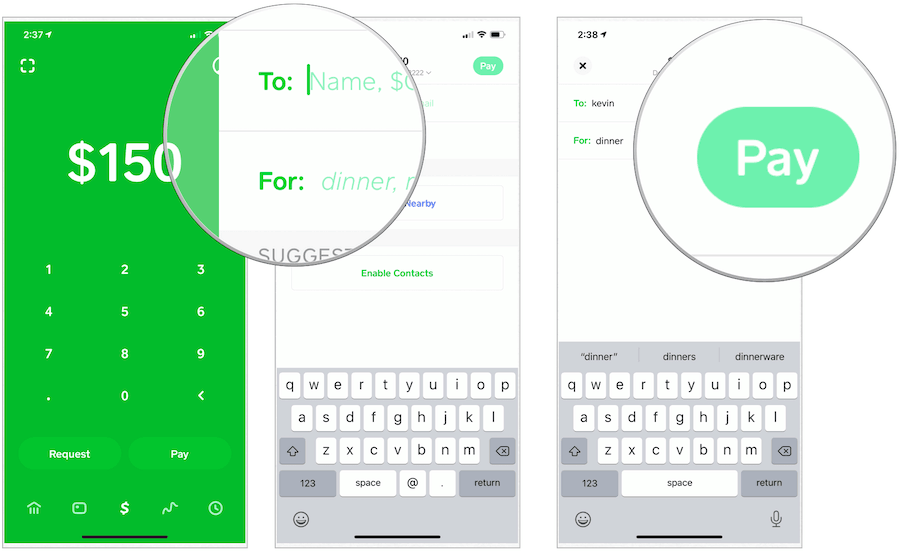

Cash App, a popular mobile payment service, does not currently allow direct transfers from credit cards. However, there are workarounds involving third-party services or specific credit cards that enable cash advances. It’s crucial to proceed with caution when considering these methods, as they often come with hefty fees and high interest rates.

Third-Party Services

Some third-party services, such as Plastiq, allow you to pay your credit card bills using your debit card or bank account. These services typically charge a fee for the transaction, ranging from 2% to 3%. Once the payment is processed, you can then transfer the funds to your Cash App account.

However, it’s important to note that these transactions may be flagged as cash advances by your credit card issuer, resulting in higher interest rates and potential penalties. Additionally, some credit card issuers may prohibit cash advances altogether.

Specific Credit Cards

Certain credit cards, such as the Venmo Credit Card, offer the ability to send money to yourself via the Cash App. However, these transactions typically come with a high cash advance fee, often around 3%. Moreover, interest charges begin accruing immediately on the transferred amount.

Using this method to send money to yourself could lead to significant financial负担 if not repaid promptly. It’s essential to consider the interest rates and fees associated with these transactions before proceeding.

Alternative Options

If cashing app yourself money from a credit card is not feasible or advisable, there are alternative options available:

- Balance Transfer Credit Card: Transfer your credit card balance to a balance transfer credit card with a lower interest rate. This can save you money on interest charges and allow you to pay down your debt faster.

- Personal Loan: Consider taking out a personal loan to consolidate your credit card debt and lower your interest payments. Personal loans typically have lower interest rates than credit cards.

- Credit Counseling: Non-profit credit counseling agencies can provide free or low-cost advice and guidance on managing debt and improving your financial situation.

Before making any decisions, it’s crucial to carefully consider your financial situation, the potential risks and costs associated with different options, and seek professional advice if necessary.

Tips and Expert Advice:

- Avoid Cash Advances: Cash advances typically come with high fees and interest rates, making them an expensive way to access funds.

- Compare Fees and Interest Rates: When considering using a third-party service or specific credit card to cash app yourself money, compare the fees and interest rates carefully.

- Use Credit Responsibly: If you must use credit to access funds, make sure to repay the debt promptly to avoid high interest charges.

- Explore Alternative Options: Consider balance transfer credit cards, personal loans, or credit counseling before resorting to cash advances.

By following these tips and seeking professional guidance when needed, you can make informed decisions about managing your finances and avoid the potential pitfalls associated with cashing app yourself money from a credit card.

FAQs on Cashing App Yourself Money from a Credit Card

- Q: Can I transfer money from my credit card to Cash App directly?

A: No, Cash App does not allow direct transfers from credit cards. - Q: What are the risks of cashing app yourself money from a credit card?

A: High fees, interest charges, and potential penalties for violating credit card terms. - Q: Are there any alternative options to cashing app yourself money from a credit card?

A: Yes, such as balance transfer credit cards, personal loans, and credit counseling. - Q: What should I consider before using a third-party service to cash app myself money from a credit card?

A: Fees, interest rates, and potential risks associated with the service. - Q: Is it advisable to use a specific credit card that allows cash advances to send money to myself via Cash App?

A: Proceed with caution due to high fees and interest charges, and consider alternative options first.

Conclusion:

Cashing app yourself money from a credit card can be a tempting but risky solution to financial challenges. Third-party services and specific credit cards offer workarounds, but they come with hefty fees and high interest rates. It’s crucial to explore alternative options and proceed with caution to avoid potential financial burdens. Remember, seeking professional advice can provide invaluable guidance and help you make informed decisions about managing your finances.

Call to Action:

If you’re considering cashing app yourself money from a credit card, take the time to thoroughly research the fees, interest rates, and risks involved. Consider alternative options and consult with a financial advisor to make the best decision for your financial situation.

Are you interested in learning more about alternative options for managing credit card debt? Let us know in the comments below!

:max_bytes(150000):strip_icc()/Cash_App_01-c7abb9356f1643a8bdb913034c53147d.jpg)

Image: mingwinslow.blogspot.com

You have read an article about Can I Cash App Myself Money From A Credit Card. Thank you for visiting our site. We hope you benefit from Can I Cash App Myself Money From A Credit Card.